Page 1 - Comparison of BLANK verses StudentSecure Plan of Tokio Marine HCC

P. 1

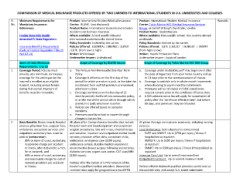

COMPARISON OF MEDICAL INSURANCE PRODUCTS OFFERED BY TWO CARRIERS TO INTERNATIONAL STUDENTS IN U.S. UNIVERSITIES AND COLLEGES

Sl. Minimum Requirements for Product: International Student Medical Insurance Product: International Student Medical Insurance Remarks

No. Mandatory Insurance: Carrier: BLANK. (not disclosed) Carrier: Tokio Marine HCC Medical Insurance Services

Product Name: International students and scholars Group, on behalf of Lloyd’s Syndicate, London.

References: Accident and Sickness Insurance Product Name: StudentSecure

Where available: Non-specific school. Any country abroad

Florida State Min Health Where available: School specific inbound worldwide.

Amended FL State Regulation international students to the United States

Policy Standards: Evolved by the carrier.

Insurance Benefits Requirement Policy Standards: Evolved by the carrier Policies offered: ELITE | SELECT | BUDGET | SMART

(Code of Federal Regulation Title 22 Policies Offered: ESSENTIAL | BRONZE | SLIVER (from high to low)

Part 62.14) |ELITE (from low to high)

Broker: Health Protection Plans

Broker: Undisclosed. Underwriter Insurer: Lloyds of London.

Underwriter Insurer: Undisclosed.

Items of state Minimum Scope of Coverage by BLANK Insurer Scope of Coverage by Tokio Marine HCC MIS Group

Requirements: 1 to 13

1 Coverage Period: Policies must a. The Policy is Non-Renewable One-Year Term a. Coverage under StudentSecure® may begin on or after

provide, at a minimum, continuous Policy. the date of departure from your home country and up

coverage for the entire period the b. Coverage is effective on the first day of the to 31 days prior to the commencement of classes.

insured is enrolled as an eligible period for which premium is paid, or the date the b. Coverage is available only in whole-month increments

student, including annual breaks enrollment form and full premium are received, when choosing to pay in monthly installments.

during that period. Payment of whichever is later. c. Premiums will be refunded in full if cancellation

benefits must be renewable. c. Coverage terminates on the last day of 12 request is made prior to the certificate effective date.

months period, the life of non-renewable policy, d. A $25 administrative fee will apply for cancellation of

or at the end of the period which through which policy after the ‘certificate effective date’, but before

premium is paid, whichever is earlier. 60 days, and premiums may be refunded.

d. Policies are offered based on semester e.

durations.

e. Premiums paid by school to insurer through

charges in tuition fee.

2 Basic Benefits: Room, board, hospital All plans offer: Comprehensive benefits that include All plans: Average semi-private room rate, including nursing

services, physician fees, surgeon fees, hospital room and board, inpatient and outpatient services:

ambulance, outpatient services, and surgical procedures, labs and x-rays, chemotherapy Local Ambulance: (not subjected to coinsurance)

outpatient customary fees must be and radiation, inpatient and outpatient mental health - ELITE and SELECT: Up to $750 per injury / illness if

paid at (coinsurance): services, physician office visits, consultant visits, hospitalized as inpatient.

- 80% or more of usual, customary, ambulance, emergency care ($200 copay), - BUDGET: Up to $500 per injury / illness if hospitalized

reasonable charge per accident ambulance service, durable medical equipment, as inpatient

or illness, after deductible is met, reconstructive breast surgery following mastectomy, - SMART: Up to $300 per injury / illness if hospitalized as

for in-network, and diabetes services, urgent care center, CAT scan/MRI inpatient

- 60% or more of usual, customary, ($200 copay), Intensive Care Unit: Up to overall maximum limit

and reasonable charge for out-of- Outpatient treatment: Up to overall maximum limit

network providers per accident Policies offer the option of a PPO network of the

or illness. insurer’s qualified medical providers. Discounted Policies offer In-Network qualified providers world over at

contract rates apply for geographical area of PPO. discounted rates, and accept U.S. based nationwide

Sl. Minimum Requirements for Product: International Student Medical Insurance Product: International Student Medical Insurance Remarks

No. Mandatory Insurance: Carrier: BLANK. (not disclosed) Carrier: Tokio Marine HCC Medical Insurance Services

Product Name: International students and scholars Group, on behalf of Lloyd’s Syndicate, London.

References: Accident and Sickness Insurance Product Name: StudentSecure

Where available: Non-specific school. Any country abroad

Florida State Min Health Where available: School specific inbound worldwide.

Amended FL State Regulation international students to the United States

Policy Standards: Evolved by the carrier.

Insurance Benefits Requirement Policy Standards: Evolved by the carrier Policies offered: ELITE | SELECT | BUDGET | SMART

(Code of Federal Regulation Title 22 Policies Offered: ESSENTIAL | BRONZE | SLIVER (from high to low)

Part 62.14) |ELITE (from low to high)

Broker: Health Protection Plans

Broker: Undisclosed. Underwriter Insurer: Lloyds of London.

Underwriter Insurer: Undisclosed.

Items of state Minimum Scope of Coverage by BLANK Insurer Scope of Coverage by Tokio Marine HCC MIS Group

Requirements: 1 to 13

1 Coverage Period: Policies must a. The Policy is Non-Renewable One-Year Term a. Coverage under StudentSecure® may begin on or after

provide, at a minimum, continuous Policy. the date of departure from your home country and up

coverage for the entire period the b. Coverage is effective on the first day of the to 31 days prior to the commencement of classes.

insured is enrolled as an eligible period for which premium is paid, or the date the b. Coverage is available only in whole-month increments

student, including annual breaks enrollment form and full premium are received, when choosing to pay in monthly installments.

during that period. Payment of whichever is later. c. Premiums will be refunded in full if cancellation

benefits must be renewable. c. Coverage terminates on the last day of 12 request is made prior to the certificate effective date.

months period, the life of non-renewable policy, d. A $25 administrative fee will apply for cancellation of

or at the end of the period which through which policy after the ‘certificate effective date’, but before

premium is paid, whichever is earlier. 60 days, and premiums may be refunded.

d. Policies are offered based on semester e.

durations.

e. Premiums paid by school to insurer through

charges in tuition fee.

2 Basic Benefits: Room, board, hospital All plans offer: Comprehensive benefits that include All plans: Average semi-private room rate, including nursing

services, physician fees, surgeon fees, hospital room and board, inpatient and outpatient services:

ambulance, outpatient services, and surgical procedures, labs and x-rays, chemotherapy Local Ambulance: (not subjected to coinsurance)

outpatient customary fees must be and radiation, inpatient and outpatient mental health - ELITE and SELECT: Up to $750 per injury / illness if

paid at (coinsurance): services, physician office visits, consultant visits, hospitalized as inpatient.

- 80% or more of usual, customary, ambulance, emergency care ($200 copay), - BUDGET: Up to $500 per injury / illness if hospitalized

reasonable charge per accident ambulance service, durable medical equipment, as inpatient

or illness, after deductible is met, reconstructive breast surgery following mastectomy, - SMART: Up to $300 per injury / illness if hospitalized as

for in-network, and diabetes services, urgent care center, CAT scan/MRI inpatient

- 60% or more of usual, customary, ($200 copay), Intensive Care Unit: Up to overall maximum limit

and reasonable charge for out-of- Outpatient treatment: Up to overall maximum limit

network providers per accident Policies offer the option of a PPO network of the

or illness. insurer’s qualified medical providers. Discounted Policies offer In-Network qualified providers world over at

contract rates apply for geographical area of PPO. discounted rates, and accept U.S. based nationwide