Page 1 - MEDICARE ADVANTAGE_Vs_MEDICARE SUPPLEMENT

P. 1

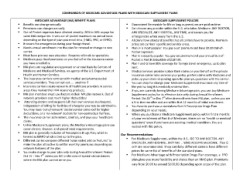

COMPARISON OF MEDICARE ADVANTAGE PLANS WITH MEDICARE SUPPLEMENT PLANS

MEDICARE ADVANTAGE (MA) BENEFIT PLANS MEDICARE SUPPLEMENT POLICIES

Benefits can change annually Guaranteed Renewable for life as long as premiums are paid on time.

Premiums can changes annually Can choose any provider within the U.S. who takes Medicare: ANY DOCTOR,

Out-of-Pocket expenses have climbed steadily: 20% to 30% copays for

ANY SPECIALIST, ANY HOSPITAL, ANY TIME, and covers you for

some MA companies. It sets out-of-pocket maximum on annual basis emergencies when away from the U.S.

All plans have standard benefits that all carriers have to provide. Premium

depending on the type of plan you enroll into. (HMO, PPO, or RPPO).

It covers for emergencies during your foreign travel. prices are carriers’ specific and service areas.

Needs annual enrollment into the plan for renewal or change to new Plans F is most popular. You pay a set premium and have $0.00 Out-of-

carrier. Pocket expenses.

Must have primary care physician. Requires referrals to specialists. Plan G is equally popular. You pay set premium and your annual Out-of-

Medicare pays fixed premiums on your behalf to the insurance carrier

Pocket is Part B deductible of $187.00.

you have enrolled in. Plan F and G have 80% coverage for foreign travel emergency, up to plan

MA plans are regulated and approved on annual basis by Centers of

limit.

Medicare and Medicaid Services, an agency of the U.S. Department of Medical services providers place their claims on your behalf on the private

Health and Human Services. insurance carrier who services your policy, prefers claims with Medicare and

The insurance carriers contract with medical and pharmaceutical picks up your share depending upon the plan you purchase with the carrier.

services providers. They can opt out ….. anytime !! You can shop for change your Medicare Supplement insurance any time of

Insurance carriers create networks of healthcare providers in service the year so long it is medically underwritten.

areas they market their MA insurance products. If you are currently having Medicare Advantage plan, you can buy Medicare

MA plan members must use doctors in their MA plan network. Out of Supplement policy for its effective date only during Annual Enrollment

network providers cost much higher deductibles! Period: Oct 15th to Dec 7th after disenrollment from MA plan, unless you are

Attending doctors and surgeons bill their own services in a hospital,

a first time enrollee and are within first 12 months of initial enrollment.

independent of billing for facilities of a hospital you may be admitted in. You have to purchase a standalone Part D Prescription Drugs Plan

You may have ‘out-of-network’ doctors under same roof for higher depending on your needs.

deductibles, or a ‘no-network’ doctors for non-contractual full fees. When you purchase a Medicare Supplement policy within first 6 months

The insurance carrier administers, controls, and pays your healthcare of your enrollment of Part B of Medicare, there are no ‘health or medical

claims. questions’ even if you have pre-existing medical condition. You are

Unlike Medicare Supplement plans, the Medicare Advantage plans can vested with this policy.

cover chronic illnesses and special need requirements.

MA plan is generally inclusive of Prescription Drugs Plan, which is Our Recommendations

For Medicare Supplement, within the U.S., GO TO ANY DOCTOR, ANY

termed as MAPD which is tied up to the plan.

Different carries compose different ‘value added add on features’ to SPECIALIST, ANY HOSPITAL, ANYTIME .. WHO ACCEPTS MEDICARE. Plan G

make the plan attractive to sell for monthly premiums depending on or F are recommended. Shop carefully: different carriers have different

network features of the plan. prices for same list of benefits of the standard plans.

You make change to your plan only during Annual Enrollment Period: For Medicare Advantage with Prescription Drugs Plan coverage, a PPO

Oct 15 – Dec 7th unless you fall under case of special circumstances plan gives you more flexibility and choice than an HMO plan. Premiums

where the MA plan cannot serve you.

vary from $0.00 to around $100.00 depending upon scope of the plan.

MEDICARE ADVANTAGE (MA) BENEFIT PLANS MEDICARE SUPPLEMENT POLICIES

Benefits can change annually Guaranteed Renewable for life as long as premiums are paid on time.

Premiums can changes annually Can choose any provider within the U.S. who takes Medicare: ANY DOCTOR,

Out-of-Pocket expenses have climbed steadily: 20% to 30% copays for

ANY SPECIALIST, ANY HOSPITAL, ANY TIME, and covers you for

some MA companies. It sets out-of-pocket maximum on annual basis emergencies when away from the U.S.

All plans have standard benefits that all carriers have to provide. Premium

depending on the type of plan you enroll into. (HMO, PPO, or RPPO).

It covers for emergencies during your foreign travel. prices are carriers’ specific and service areas.

Needs annual enrollment into the plan for renewal or change to new Plans F is most popular. You pay a set premium and have $0.00 Out-of-

carrier. Pocket expenses.

Must have primary care physician. Requires referrals to specialists. Plan G is equally popular. You pay set premium and your annual Out-of-

Medicare pays fixed premiums on your behalf to the insurance carrier

Pocket is Part B deductible of $187.00.

you have enrolled in. Plan F and G have 80% coverage for foreign travel emergency, up to plan

MA plans are regulated and approved on annual basis by Centers of

limit.

Medicare and Medicaid Services, an agency of the U.S. Department of Medical services providers place their claims on your behalf on the private

Health and Human Services. insurance carrier who services your policy, prefers claims with Medicare and

The insurance carriers contract with medical and pharmaceutical picks up your share depending upon the plan you purchase with the carrier.

services providers. They can opt out ….. anytime !! You can shop for change your Medicare Supplement insurance any time of

Insurance carriers create networks of healthcare providers in service the year so long it is medically underwritten.

areas they market their MA insurance products. If you are currently having Medicare Advantage plan, you can buy Medicare

MA plan members must use doctors in their MA plan network. Out of Supplement policy for its effective date only during Annual Enrollment

network providers cost much higher deductibles! Period: Oct 15th to Dec 7th after disenrollment from MA plan, unless you are

Attending doctors and surgeons bill their own services in a hospital,

a first time enrollee and are within first 12 months of initial enrollment.

independent of billing for facilities of a hospital you may be admitted in. You have to purchase a standalone Part D Prescription Drugs Plan

You may have ‘out-of-network’ doctors under same roof for higher depending on your needs.

deductibles, or a ‘no-network’ doctors for non-contractual full fees. When you purchase a Medicare Supplement policy within first 6 months

The insurance carrier administers, controls, and pays your healthcare of your enrollment of Part B of Medicare, there are no ‘health or medical

claims. questions’ even if you have pre-existing medical condition. You are

Unlike Medicare Supplement plans, the Medicare Advantage plans can vested with this policy.

cover chronic illnesses and special need requirements.

MA plan is generally inclusive of Prescription Drugs Plan, which is Our Recommendations

For Medicare Supplement, within the U.S., GO TO ANY DOCTOR, ANY

termed as MAPD which is tied up to the plan.

Different carries compose different ‘value added add on features’ to SPECIALIST, ANY HOSPITAL, ANYTIME .. WHO ACCEPTS MEDICARE. Plan G

make the plan attractive to sell for monthly premiums depending on or F are recommended. Shop carefully: different carriers have different

network features of the plan. prices for same list of benefits of the standard plans.

You make change to your plan only during Annual Enrollment Period: For Medicare Advantage with Prescription Drugs Plan coverage, a PPO

Oct 15 – Dec 7th unless you fall under case of special circumstances plan gives you more flexibility and choice than an HMO plan. Premiums

where the MA plan cannot serve you.

vary from $0.00 to around $100.00 depending upon scope of the plan.